Systematic Investment Plan (sip)

It is considered a good practice to invest regularly, Particularly into volatile markets such as equity

Markets.SIP is an approach where the investor invests constant amounts at regulat Intervals.

SiP need to disiplian in investment.Regularly invest in fund create a disiplian in SIP.

Suppose some one investor were want to invest 1000 per month currant month NAV is RS10 ,then investor is allotted RS 1000/10=100units and second month is NAV is 12 RS then alloted unit is

1000/12=83.3333 next month NAV is go down to RS 9 then alloted unit is 1000/9=111.11 that is higer her you look unit price is incerase and allotment of unit with current price. In MutualFud we saveing in unit that price increase in further .Mutual Fund behave with market up and down.

We talk on some point on saving

Saving refer to the exess income available to an individual or household after meeting current expenses.Some fund available after expense that fund we think to invest for good return in

further .We all invest in bank deposit and Government securities,bond,Treasury Bills that is safe invest but there return is low. Another product is we invest in Gold most poplar product for invest .

It safe investment most popular investment but Gold not take part in economy most people put gold for long time of investment .We import most gold Then government decide to demonetization the gold government introduced Sovereign gold bond. I talk about Sovereign gold bound another time.

I am always promte equity investment throug sip that return is high that refflect market return.

I go to story some one want to buy cake that price is high then he think to small part of that cake another part in next time . then one time he buy whole part of cake.

Another story some one want car and he get that car in instalment from shop.

That is do in SIP her our goal of investment and disiplian is mean point .Her we talk goal is 25 lake in 20 year . Her we sip for achieved that goal.

Her the exam

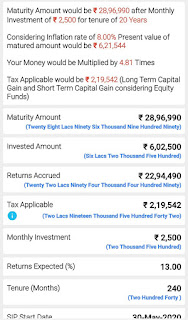

Monthly Investment 2500 Return 13% investment Period 20 year inflation rate is 8%

Maturity Amount Would be Rs 28,96,990 that is our goal to achieved.Anoter populer investment is rdInvestment of 2500 Return 6% Investment Period is 20 years Maturity Amount 11,56,785rd and fd is safe investment but there return is zero that investment not bit nflation. pramod kumar 7903812430

Comments

Post a Comment