Human Life protfolio Management

Stages of the Human Life Cycle

1.Birth-When a child is born .New Life May bring something new and special into the world.

2.Middle Childhood - Form that time child Education is Start his fist school Education. From her we start Investment on Education .

3.Early Adulthood (20-35)- From that time Higher Education is start .Their many responsibilities, including finding a home and mate,establishing a family or circle of friends , and getting a good job.

4.Midlife(35-50)-People in midlife often take a break from worldly responsibilities to reflect upon the deeper meaning of their lives.

5.Death And Dying life -Those in our lives who are dying or who have died.

Another thing is risk that present from birth from life is diseases and death. that is present from birth. In we all in childhood that time our parents take care and all investment on education and diseases that we faced .

In Adulthood all person start new Life that time is 20-35 there he married some one and start new Life in that world. From there her Responsibility start for his new life ther need a portfolio management that is human life portfolio management. That is related to each stages of life and how mange risk and planning for that risk management available tool in financial intermediaries .

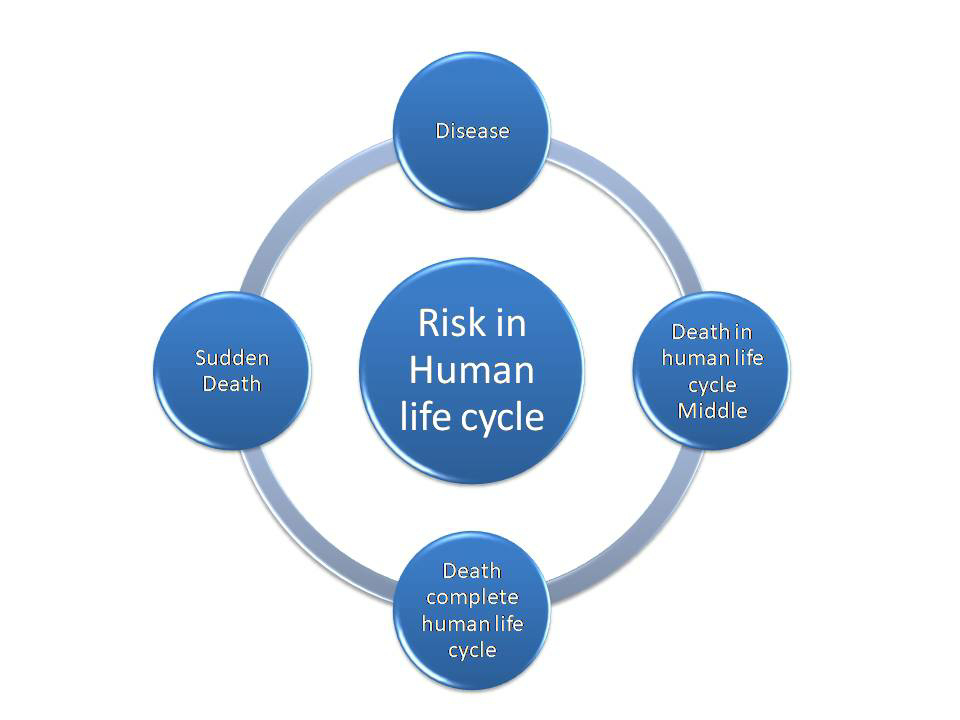

Risk in human life Cycle

We all know that death is part of life every who come in that world that is one day gone that is confirmed truth in life Cycle.

The risk namely death is certain in life.

I am talking on death in middle of life and sudden death. uncertainty is present in life we need to planning for what after my life of my family. that is biggest fear of life and risk that risk is managed by planning useing some financial intermediaries .

Need Analysis in Human life

Fist we need to create portfolio of person

that is deppend on questions and answers

1. Income of person

2. Famale member

3. Children in female

4. savings of person

common concept of economics is demand and supply that is work her demand side is risk and supply side is financial intermediaries.

Our all concept around his saving how he invest and manage that savings to make better his family life from use financial intermediaries insurance.

what is Insurance?

Insurance is contract between two parties, where one promises the other to indemnify or make good any financial loss suffered by the insured for that person can pay a amount as premium. The contract offerd as the policy.The may thing in insurance is to protect against loss of life and health . In contract of insurance the insurer agrees to make any loss on the insured life and health that cover by insurer that on both part agrees.

Contract of indemnity

Section 124 of the indian contract act 1872 provided that A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself,pr by the conduct of any other person ,is called a contract of indemnity.

Life Insurance

The insurance Regulatory and Development authority was constituted as an autonomous body to regulate and develop the business of insurance and reinsurance in the country .

IRDA

The insurance regulatory and development authority was constituted as an autonomous body to regulate and develop the business and reinsurance in the country.

Life Insurance

The risk namely death is certain in life insurance.

that insurance cover death after family economically help. After death family received death claims . when we selected one another option as rider Critical illness rider than any illness like heart attack company can provide some many and waves the premium.

Health insurance

health insurance covers medical expenses.

Many insurance company provide cash less facility to insured persons. another option in that family health insurance.

Family Floater

The family consisting of spouse dependent children and dependent parents are offered a single sum insured which floats over the entire family.

Insurance Doccuments

A. proposal form

B. Acceptance of the proposal (underwriting)

C. prospectus

D. Premium receipt

E. policy Documents

F. condition and warranties

G. Endorsements

H. Interpretation of policies

I. Renewal notices

J. Ant money Laundering

Portfolio management

we take one person income and saving .our portfolio management move across his saving.

His saving is 37800 that is the savings of that person.

Our risk management plan are

Total cost for risk management is 112000 that is pay in monthly premiums in 12 month insolvent.

https://www.youtube.com/@pramodkumar-1510

ReplyDelete